In the past two weeks I had consultations with several kababayans who received an Invitation to Apply to Sponsor their parents. One of them asked if he must show the minimum necessary income plus 30%, varying for family size, for the last fiscal years to be eligible to sponsor his parents under Super Visa category.

I think my kababayan asking the question is confused between the income level required to sponsor parents for permanent residence as opposed to the income level required to sponsor parents for a super visa. I would like to clarify that to sponsor your parents under Super Visa, you don’t need to show IRCC that you meet the MNI +30% for multiple consecutive years- this is an eligibility requirement that an applicant must meet when sponsoring parent for permanent residence status.

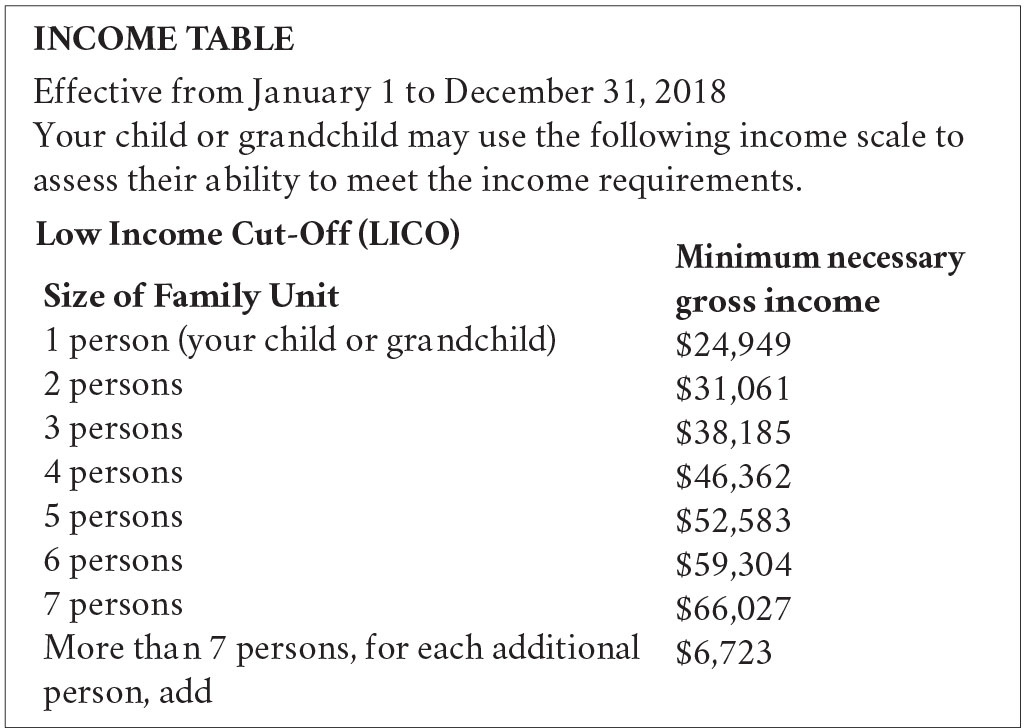

The Super Visa is a variant of Temporary Resident Visa (TRV) which offers the additional benefit of being able to visit Canada for up to two (2) years as compared to the usual duration of six (6) months that comes with a regular TRV. If you review the policy for Super Visa the guidelines clearly indicate that the sponsor must meet MNI (LICO) for the current year (not three years), and there is no need to add the 30%. Pleasesee the table below to check the relevant income requirements.

Guidelines specify that you can have a co-signer if the sponsor does not meet the required LICO level.

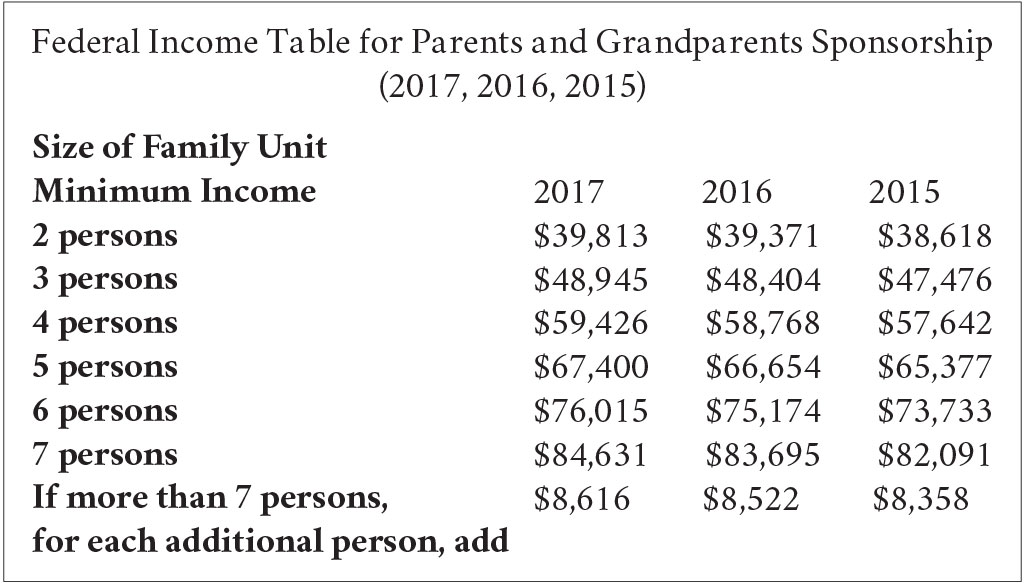

When sponsoring parents or grandparents and their dependents for permanent residence, the sponsor must meet MNI plus 30% for three consecutive tax years prior to filing the sponsorship. This number is arrived at by taking the Low Income Cut Off calculated annually by Statistics Canada for the relevant family size, and adding 30%. IRCC offers a very handy chart below:

Federal Income Table for sponsors of parents and grandparents

The following table applies to residents of all provinces except Quebec. For each of the three consecutive taxation years preceding the date on which the application is submitted to us, the sponsor (and co-signer, if applicable) must meet the Minimum Necessary Income, which is based on the Low Income Cut-offs plus 30%.

You must provide your Notice of Assessment from the Canada Revenue Agency (CRA) as proof that you meet the following minimum income requirements for taxation years 2017, 2016, and 2015.

Based on the above table, IRCC has already added on the extra 30% thus there is no need to add or calculate and do the math. If the Sponsor follows the above chart the only thing to consider is determine the appropriate size of the family unit.

If you have questions regarding the above article you may contact Marjorie at info@mcncanadaimmigration.com

Source: Immigration, Refugees and Citizenship Canada (IRCC)